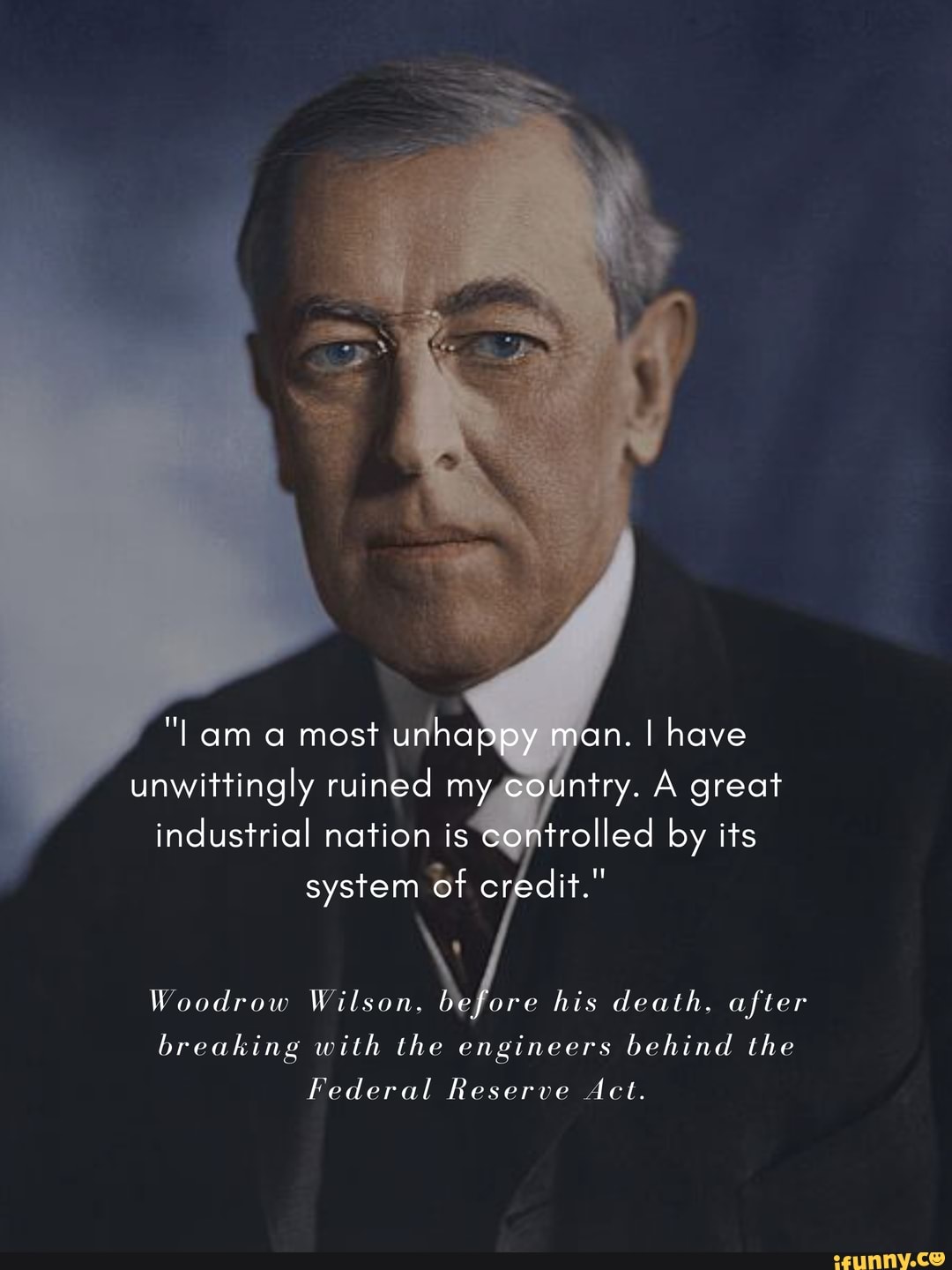

On December 23, 1913, President Woodrow Wilson signed the Federal Reserve Act into law, creating the United States' central banking system. This marked a pivotal moment in financial history.

Wilson was pressured by powerful private banking interests to sign the bill, despite his initial reservations. The Federal Reserve was publicly presented as providing the nation with a safer, more flexible, and more stable monetary and financial system... but as we will show - it was something else completely.

While publicly presented as a stabilizing force, the Federal Reserve Act institutionalized the debt-based money creation system that would come to dominate global finance and concentrate monetary power in the hands of the same private bankers who pressured Wilson into signing it.

The Income Tax Connection

The Federal Reserve's creation coincided with the ratification of the 16th Amendment in 1913, which established the federal income tax. This was no coincidence - the income tax provided the mechanism to finance the government debt (and especially the interest payments) by extracting wealth directly from the public through taxation, while presenting it as a "progressive" measure.

This chapter reveals how the Federal Reserve systematically inflated the debt bubble - creating the perfect conditions for the massive wealth transfer that would follow in the Great Steal chapter.

The Bubble Inflation Pattern

- •Debt Bubble: Inflated from $48B to $128B (167% increase)

- •Market Manipulation: Stock market volatility created wealth transfer opportunities

- •System Fragility: Economic stability collapsed from 85% to 25%

- •Intentional Setup: Perfect conditions created for the coming Great Steal

Next Chapter: The Great Steal reveals how this inflated bubble was intentionally burst to transfer wealth from the public to financial elites.

The Bubble Inflation Engine (1913-1921)

This visualization shows how the Federal Reserve systematically inflated the debt bubble through WWI financing. The explosive growth in public and private debt, combined with stock market manipulation, created the perfect conditions for the coming wealth transfer.

Key insight: The Federal Reserve created the bubble that would be burst in the Great Steal - transferring wealth from public to private hands

War Bonds: Financing Conflict Through Debt

The Federal Reserve's creation coincided with the need to finance World War I, establishing a pattern where central banking and war financing became inextricably linked. War bonds became the mechanism to transform public savings into government debt for military expenditure.

The Liberty Bonds campaigns of 1917-1918 raised over $21 billion from American citizens, creating a precedent where ordinary people's savings were channeled into government war efforts through debt instruments.

This established the blueprint: central banks create the money, governments issue the debt, and citizens fund the wars - all while private banking interests profit from the arrangement.

The War Bond Mechanism:

- •Government issues bonds to finance military operations

- •Central banks purchase bonds, creating new money

- •Public buys bonds with savings, funding government debt

- •Private banks profit from bond underwriting and interest

- •Taxpayers repay the debt with interest over generations

The Jekyll Island Connection

The Federal Reserve System didn't emerge from public debate. In 1910, a secret meeting took place on Jekyll Island, Georgia, where leading bankers and politicians drafted the framework for what would become the Federal Reserve.

This secretive origin story highlights how financial systems are often shaped by elite interests rather than democratic processes.

The Jekyll Island Participants