The Great Steal Mechanism

The "Great Depression" wasn't an accident - it was the deliberate orchestration of the single greatest transfer of real, tangible wealth from the public to the financial elite in modern history.

This wasn't a market glitch; it was a systematic wealth transfer executed through coordinated monetary policy and engineered boom-bust cycles that followed a predictable pattern.

The Market Collapse (1921-1933)

671923

861925

1061927

1521929

3811931

1351933

99

The Human Impact

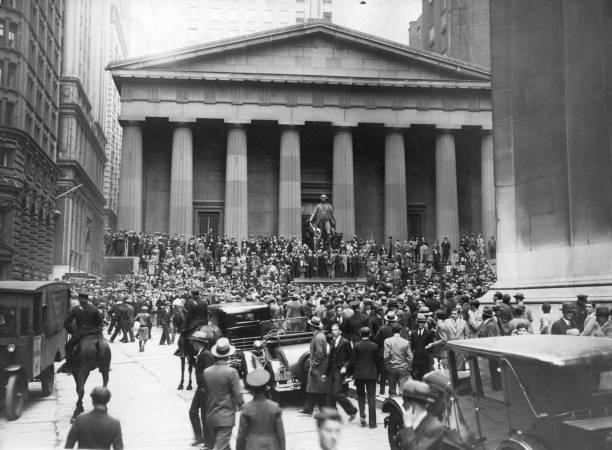

Crowd during the Great Depression - illustrating the widespread impact

Phase 1: The Fuel (1921-1929)

The Federal Reserve floods the economy with easy credit, creating the "Roaring Twenties" bubble. The public is encouraged to participate in the stock market "on margin" - buying stocks with debt.

Phase 2: The Hook (1929)

To secure these loans, ordinary people pledge their real assets as collateral: their farms, homes, and businesses. The debt bubble becomes unserviceable as the interest leak runs its course.

Phase 3: The Steal (1929-1933)

The Fed and major banks coordinate to withdraw liquidity, tightening credit and raising interest rates. When the bubble pops, margin calls trigger mass liquidations, forcing the public to sell assets for pennies on the dollar.

Sharecroppers on the road in Missouri, January 1939 - victims of the wealth transfer

The Wealth Transfer Numbers

- •Stock market lost 89% of its value (1929-1932)

- •Over 9,000 banks failed (1930-1933)

- •25% unemployment rate (1933 peak)

- •Farm foreclosures: 750,000+ families lost land

- •Home foreclosures: 1+ million families displaced

Phase 4: The Transfer (1933+)

When debt payments can't be met, banks foreclose on the real collateral - farms, homes, businesses. Financial elites acquire real wealth at massive discounts, completing the greatest wealth transfer in modern history.

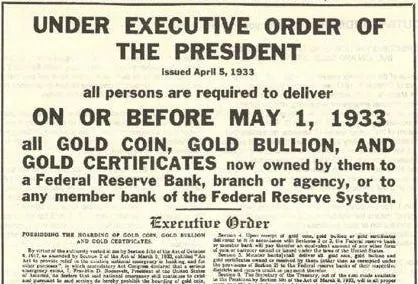

The Gold Confiscation (1933)

President Roosevelt removed the U.S. from the gold standard for domestic transactions and issued Executive Order 6102, forcing citizens to surrender gold to the government in exchange for paper currency.

Gold confiscation - transferring wealth from citizens to the state

The Great Steal: Wealth Transfer Lines (1929-1933)

This simplified line graph shows how the stock market crash (-70%) transferred wealth from the public (-65%) to financial elites (+100%) during the Great Depression.

Three lines clearly show the inverse relationship: as stock market and public wealth fall, elite wealth rises

The Great Wealth Transfer (1929-1933)

This visualization clearly illustrates the systematic transfer of $450 billion in wealth from the public to financial elites during the Great Depression.

The stacked bars clearly show the $450 billion wealth transfer from public to elite hands

The Pattern: Engineered Boom-Bust Cycles

The "Great Steal" established a pattern that would repeat throughout the 20th and 21st centuries: create easy credit bubbles, encourage public participation with debt, then withdraw liquidity to trigger collapse.

This wasn't market failure - it was system design. The Federal Reserve, created in this period, demonstrated its true purpose: not to stabilize the economy, but to systematically transfer wealth from the many to the few.

The Steal Mechanism:

- •Create Bubble: Flood economy with easy credit

- •Encourage Debt: "Everyone can be rich" narrative

- •Secure Collateral: Real assets pledged for loans

- •Withdraw Liquidity: Coordinate credit tightening

- •Trigger Collapse: Margin calls force liquidations

- •Transfer Wealth: Foreclose on real collateral

The Aftermath: Consolidating Control

The New Deal wasn't about helping ordinary people - it was about institutionalizing the power structurethat had just completed the greatest wealth transfer in history.

By creating regulatory agencies and safety nets, the system gave the appearance of reform while actually cementing the mechanisms of control that would enable future wealth transfers on an even larger scale.

The 1933 Gold Standard Removal

In 1933, President Franklin D. Roosevelt took the U.S. off the gold standard for domestic transactions and issued Executive Order 6102, which prohibited the hoarding of gold coins, bullion, and certificates.

- •Required individuals to turn in their gold to the government in exchange for paper currency

- •Effectively confiscated citizens' gold holdings at the official price of $20.67 per ounce

- •Government immediately revalued gold to $35 per ounce, transferring wealth from citizens to the state

- •Paved the way for unlimited monetary expansion without gold backing

Institutionalized Control:

- •FDIC: Guaranteed bank deposits (protecting the system)

- •SEC: Regulated markets (creating illusion of safety)

- •Social Security: Created dependency on the state

- •Glass-Steagall: Appearance of reform while core remained

- •Expanded Fed Powers: Strengthened central control

- •Gold Confiscation: Removed monetary constraint and transferred wealth

International Context: The Global Steal

🇬🇧Britain's Gold Standard Departure (1931)

In September 1931, Britain abandoned the gold standard, a move that devalued the pound by 30% and enabled massive monetary expansion. This wasn't just economic policy - it was a strategic move that:

- •Enabled Britain to export its way out of depression at others' expense

- •Set the precedent for competitive devaluations worldwide

- •Accelerated the collapse of the international gold standard system

🇩🇪German Banking Reforms (1930s)

The restructuring of Germany's banking system in the early 1930s created the financial architecture that would later finance the German war machine. These reforms:

- •Consolidated banking power under state control

- •Enabled massive credit expansion for rearmament

- •Created the monetary foundation for military buildup

- •Demonstrated how banking systems could be weaponized