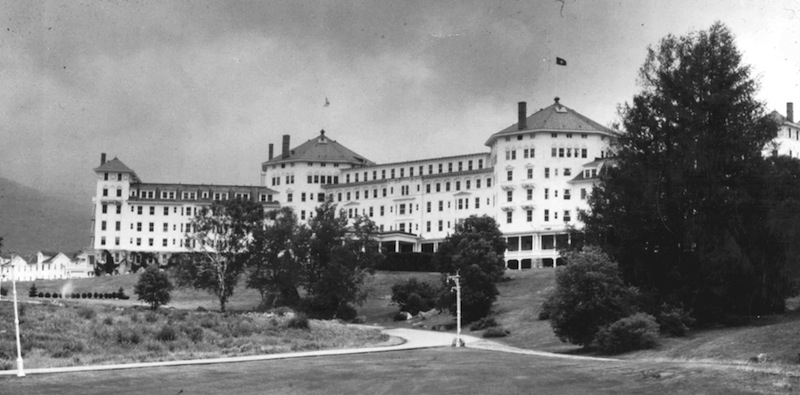

The Bretton Woods Conference

The Bretton Woods Conference, July 1944 - 44 nations established the dollar as global reserve currency

In July 1944, representatives from 44 Allied nations gathered in Bretton Woods, New Hampshire to design the post-WWII international monetary system. The result was a system of fixed exchange rates pegged to the US dollar, which was convertible to gold at $35 per ounce.

This system established the US dollar as the world's reserve currency, creating the foundation for dollar hegemony that would shape global finance for decades.

While publicly presented as a stabilizing force for global trade, Bretton Woods institutionalized a mechanism where the US could finance unlimited deficits by forcing other nations to hold dollars as reserves, creating a perpetual demand for US debt that allowed continuous monetary expansion without immediate consequences.

Global Context in 1944

- •World War II ending, massive reconstruction needed

- •US holds 75% of world's official gold reserves

- •European economies devastated by war

- •Global Debt-to-GDP ratio: ~310% (WWII peak)

The Bretton Woods Anomaly (1944-1971)

Why Debt-to-GDP Sank After WWII

The period from 1944-1971 appears as an anomaly where global debt-to-GDP actually decreased. This "Golden Age" had two primary explanations:

1. Inflationary Erosion

The enormous war debt was "watered down" by real GDP growth and moderate inflation. As economies grew and prices increased, the relative burden of existing debt decreased.

2. The Dollar's "Free Rider" Effect

Under Bretton Woods, the US dollar became the global reserve currency. The US could externalize monetary costs - forcing other nations to absorb US debt growth and inflation through their dollar reserves, creating an illusion of stability while exporting financial instability globally.

The System's True Nature

Bretton Woods created a temporary stability by making the world absorb US debt. When this system collapsed in 1971, the true exponential nature of debt growth was revealed.

The Dollar Hegemony Cycle

This visualization illustrates how the Bretton Woods system enabled the US to externalize monetary costs by forcing other nations to absorb US debt growth and inflation through their dollar reserves, creating an illusion of stability while exporting financial instability globally.

The flow diagram shows how dollar creation and inflation export from the US forces other nations to absorb debt and financial instability

The Nixon Shock (1971)

On August 15, 1971, President Richard Nixon unilaterally suspended the convertibility of the US dollar to gold, effectively ending the Bretton Woods system. This marked the beginning of the fiat currency era.

The "Nixon Shock" revealed that the US could no longer sustain its gold commitments, exposing the fundamental instability of the dollar hegemony system and setting the stage for the exponential debt growth that would follow.

Immediate Consequences:

- •Transition to floating exchange rates

- •End of dollar-gold convertibility

- •Beginning of pure fiat money system

- •Acceleration of global debt accumulation